Replies to my critics

Last week, I argued that the short run is short—that there is good reason to believe that we’re now past the point where monetary stimulus can do much to help the economy. Again, I am broadly friendly to market monetarism and not especially hawkish on inflation. I am not so much against QE3 as skeptical that it will work. I think that the broad facts and a lot of mainstream macro theory back me up.

My post garnered a fair bit of criticism around the blogosphere. Let me make one quick empirical point to get everyone on the same page, and then I will try to respond to my critics point by point.

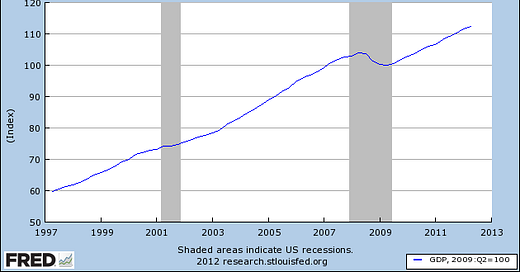

The empirical point is summed up in the graph below. NGDP grew around 5 percent per year until around 2008, and then it fell, and then it grew at around 5 percent—or slightly less—per year again beginning in mid 2009. These facts are well known, but I bring them up here because they do constrain the kind of stories we can tell about the economy. Any story you tell has to contain a one-time shock that ended years ago, and it has to be consistent with NGDP that has grown at about the same rate over the last 3 years as it did before the shock arrived.

OK, now with that out of the way, let’s take the criticisms one by one.

Bryan Caplan and ADP unemployment

Bryan cites Akerlof, Dickens, and Perry on long-run unemployment as a reason why QE3 might boost employment in spite of the fact that we are out of what we would conventionally call the short run. The ADP model assumes heterogeneous firms and workers with money illusion. At any given time, some firms need to cut real wages, and since nominal cuts hurt morale, higher inflation helps those particular firms cut wages instead of jobs. Consequently, in a low-inflation environment, monetary stimulus can help lubricate the employment market.

This argument is a good one as far as it goes. Unfortunately, I don’t think it goes very far given the stylized facts. As I noted above, NGDP is growing at a rate of 4-5 percent per year, not that different from before the crash. So any long-run ADP-style unemployment should be about the same now as it was before the crash unless there was a structural change in the economy. You can’t have it both ways—if we’re in a low-inflation environment for ADP purposes now, then we were in a low-inflation environment for ADP purposes before the crash as well.

Furthermore, assuming QE3 is a temporary policy, then if unemployment is long-term ADP unemployment, the effect of QE3 on unemployment will be temporary. I would regard a temporary dip in unemployment as a result of QE3 as good but underwhelming, given the claims of many market monetarists. There may of course be interactions between short-run unemployment and ADP unemployment, and for that reason, the dip in unemployment may not literally be temporary, but I would be surprised if QE3 could fix the economy through this channel.

Bryan makes an interesting linkage between my views on the ZMP hypothesis and ADP unemployment. If there is a decreasing secular trend of low-skill labor productivity, then ADP unemployment will become more serious over time. I think this is a good point, and it pushes me at the margin to favor a higher long-run NGDP target than I otherwise would. I was previously inclined to believe that the exact value of the target doesn’t matter once you get to levels of around 3 percent, but now I see more merit in a higher target.

Insider-outsider models

Bryan and some of the commenters at MR say that it is a mistake to focus on the wage demands of the unemployed. Rather, it is the wage demands of the employed that are especially sticky. The failure of insider wages to adjust downward to long-run levels means that there’s no ability to hire outsiders at below long-run levels, either because companies can’t afford to do it or because they are afraid of hurting insider morale.

The problem is that even if this story is true, we are probably, again, out of the short run. NGDP is almost 10 percent higher now than it was at the pre-crash peak. The number of people employed, even with population growth, is still below the pre-crash peak. Even assuming that insider nominal wages are totally inflexible, nominal output per worker has grown fast enough that insider real wages have probably adjusted. Furthermore, in five years, a non-trivial fraction of insiders retire or change jobs.

More generally, I’ve never been a fan of insider-outsider models, at least not for the United States in recent times. Maybe it makes sense as a model of Europe or Detroit in the union heyday. But today in the US, “labor” is less homogeneous than ever, private sector unions have declined, and fewer workers have an expectation of lifetime employment. Yet the past three recoveries have been increasingly jobless! How can you square the fact that at a time when the insider-outsider distinction is weaker than ever, labor hoarding has basically ended and labor market adjustment has become more difficult? I do it by assuming that the insider-outsider mechanism does not play that big of a role.

But again, even if the insider-outsider story was true at the beginning of the recession, there is little reason to believe that it is still true.

Ryan Avent and corporate profits

At the Economist, Ryan Avent focuses on my point that corporate profits are at record highs.

Firms could be enjoying high profits simply because revenues have stabilised while costs are low, perhaps because low expectations for future nominal spending growth have discouraged investment.

First, note that in the series I cited, corporate profits are adjusted for inventory valuation and capital consumption. The purpose of these adjustments is to make the series less responsive to exactly the kind of behavior Ryan posits. If firms decide not to invest in production and simply sell out of inventory instead, that can increase profits, but it doesn’t increase profits adjusted for inventory valuation. Likewise, a firm can temporarily increase profits by making inefficient use of existing equipment, which could lead to faster depreciation. Are these adjustments perfect? No. But they do offset some of Ryan’s concerns. Corporate profits are high even when you subtract some of the temporary gains firms get from not investing. The unadjusted series is here, by the way; I avoided it because I anticipated Ryan’s argument.

Second, whatever firms' expectations were, as I’ve said repeatedly, nominal spending growth has not been especially low in the last three years. A better story, if you are trying to resist structural theories, might be that firms are wary of investing due to fears of shocks from Europe or Asia, which monetary easing now does little to help. It would be great if the Fed would commit now to keeping NGDP growing at 4-5 percent when those shocks do hit, but in the meantime, I am not expecting a lot out of QE3.

Ryan also makes a couple of other points, but none of them cut to the heart of my critique of QE3 optimism. He gestures to the New Keynesian literature, but of course even the New Keynesians don’t argue that the short run lasts forever. And Mankiw, who is one of the authors Ryan cites, is a well-known proponent of the unit root hypothesis. I do not read Mankiw as expecting a return to trend, no matter what monetary policy is, although I of course do not speak for him and am happy to be corrected. Ryan also quotes Weitzman on how increasing returns creates unemployment, which is true, but tautologous: if there were no increasing returns, anyone who was unemployed could start his own firm and be just as productive as when he was employed.

Bill Woolsey

Bill Woolsey cordially welcomes me, despite my heterodoxy, to the market monetarist club. I am glad to make the cut.

I think that I failed to make myself clear in my original post. Bill says, “Dourado’s version of how shifts in nominal GDP impact real output and employment is based upon an assumption of market clearing.” This is not what I intended to convey. I think that part of the effect of nominal shocks propagates through market-clearing monetary misperceptions (Lucas islands), and the rest through non-market-clearing nominal rigidities, or as I wrote in the original post, “because some wages, prices, and contracts don’t adjust instantaneously.” I am not as New Classical as Bill seems to think. I like some elements of the New Classical school, but in the end I think the correct theory of macro for now is pluralism.

In the long run, I do think that markets mostly clear. And I think that Bill must agree, for he writes at the end of his post:

On the other hand, most of us do believe that firms eventually cut prices and wages in the face of persistent surpluses of output and labor. Most of us remain puzzled by the slow adjustment.

This is my point. If our problems were purely cyclical, “eventually” would have happened already, so our problems must not be purely cyclical. Time to start looking at structural explanations.

Scott Sumner and cutting-edge research

I was pleased to get a reply from the high priest of market monetarism himself, Scott Sumner.

I addressed the plausibility of sticky wages here, and in numerous other posts in reply to Tyler Cowen and George Selgin. I’d also point out that there is lots of cutting-edge research that tells us that the “common sense” approach to the wage stickiness hypothesis is not reliable. By common sense I mean; “Come on, wouldn’t the unemployed have cut their wage demands by now.” Yes, they would have, but that doesn’t solve the problem. This is partly (but not exclusively) for reasons discussed in this recent Ryan Avent post.

Well ok, I followed the first link, which gives the usual argument and then ends with the line, “Until we get a more plausible theory of unemployment, I’m sticking with stickiness.” This is honest, and it certainly is a common view, but I don’t think it’s a good idea to rely so heavily on a theory just because we don’t understand competing theories well yet. Macro of the gaps, I call it.

We have a long way to go in macro, so I’m glad that Scott brings up the issue of cutting-edge research. If he has particular examples of recent work that undermines the common sense approach, he should write about them at greater length. I assume that when he says “cutting-edge” he is not referring to the papers cited in Ryan’s post, since those are both from the 1980s.

Speaking of cutting edge research, let me point everyone to a paper, “Countercyclical Restructuring and Jobless Recoveries,” by David Berger, a new PhD from Yale, and now a professor at Northwestern. Berger creates a model in which firms grow fat during expansions and respond during recessions by laying off their least productive workers. His model creates jobless recoveries and matches the new stylized facts (they have changed since the 1980s) about business cycles pretty well.

One thing that I like about the Berger paper is that it shows why some nominal shocks, if not addressed immediately, are not easily reversible by monetary authorities. Once a firm has fired its least productive workers, it is not going back. If the monetary authority wants to prevent a recession, at least post-1984, it needs to act before firms lay off their workers. This perspective actually bolsters the case for NGDP targeting, because it means that the Fed should have an apparatus in place now so that the economy will be automatically stabilized when the next shock hits. Here is Tyler on Berger.

My question for Scott, since he’s so interested in cutting-edge research, is: “What do you think about Berger’s paper?” I assume that Scott is familiar with the changes in business cycles that Berger documents. Does he not think that Berger’s model accounts for some significant fraction of our current unemployment better than simply sticky wages forever?

The bottom line

None of my critics seem to be willing to make any sort of broadly falsifiable claim about how long the short run lasts. (I should say that Bryan is not arguing that we are necessarily in the short run in the bulk of his post). There is a lot of assuming trend stationarity, talk about output gaps, and pointing to literature I am well aware of—in short, a lot of question begging.

I would like to see a greater emphasis in the blogosphere on understanding stylized facts about recessions, a greater willingness to explore micro phenomena (even if we are not using fully microfounded models), and more macro-ecumenicism. No one school of macro has it all figured out, and that includes market monetarism. There is enough ambiguity in our current situation that reasonable people can disagree about what is going on. But I don’t think that reasonable people can be totally certain that all we need is more nominal stimulus.